CHAPTER 18 Externalities, Commons, and Public Goods

MULTIPLE CHOICE

Choose the one alternative that best completes the statement or answers the question.

1) If children go to school and become productive members of society,

A) a negative externality is created by the schools.

B) a positive externality is created by the schools.

C) no externality is created by the schools.

D) an externality is created that may be positive or negative.

Answer: B

Diff: 0

Topic: Externalities

2) Positive externalities are created when

A) other consumers reduce their demand for coffee and price thereby declines.

B) farmers spray pesticide in their fields and it washes into the local river after the first rainstorm.

C) your neighbor plants beautiful trees and flowers in her yard.

D) you purchase the "Mona Lisa" and lock it in a vault.

Answer: C

Diff: 0

Topic: Externalities

3) Negative externalities are created when

A) an increase in the price of butterfat drives up the price of ice cream.

B) a driver leaves his car in a parking space after the meter expires and receives a ticket.

C) a driver drives recklessly on a busy highway.

D) a driver pulls over to help a stranded motorist fix a flat tire.

Answer: C

Diff: 0

Topic: Externalities

4) If a production process creates pollution, a competitive market produces excessive pollution because

A) the firms do not include the social cost of the pollution in their profit-maximizing decisions.

B) the firms place too high a price on society's cost of inflation.

C) people are not injured by the pollution.

D) zero pollution is optimal.

Answer: A

Diff: 1

Topic: The Inefficiency of Competition with Externalities

5) If a production process creates pollution, a competitive market produces excessive pollution because

A) private marginal cost of pollution exceeds its social marginal cost.

B) social marginal cost of pollution exceeds its private marginal cost.

C) the marginal benefit of pollution to the firm is zero.

D) zero pollution is optimal.

Answer: B

Diff: 1

Topic: The Inefficiency of Competition with Externalities

6) In the presence of no externalities,

A) social marginal cost exceeds private marginal cost.

B) social marginal cost is less than private marginal cost.

C) social marginal cost equals private marginal cost.

D) social marginal cost and private marginal cost cannot be compared.

Answer: C

Diff: 1

Topic: The Inefficiency of Competition with Externalities

7) If a production process generates pollution, then a competitive market will

A) produce more of the good than is socially optimal.

B) produce less of the good than is socially optimal.

C) produce the socially optimal quantity of that good.

D) produce zero output.

Answer: A

Diff: 1

Topic: The Inefficiency of Competition with Externalities

8) In the presence of an externality, a specific tax can achieve the social optimum because

A) output is reduced to zero as a result.

B) it internalizes the external cost.

C) it directly charges the producer for polluting.

D) the price of the good rises by the full amount of the tax.

Answer: B

Diff: 1

Topic: The Inefficiency of Competition with Externalities

9) If a production process generates pollution, then a competitive market will produce more of the good than is socially optimal because

A) firms take all costs into consideration.

B) firms incur all costs of production but ignore some of them.

C) firms ignore the costs of production that they do not incur.

D) firms set price equal to social marginal cost.

Answer: C

Diff: 1

Topic: The Inefficiency of Competition with Externalities

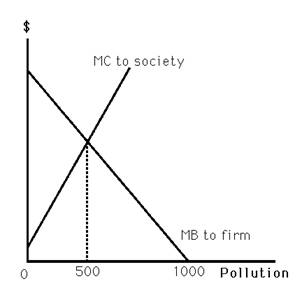

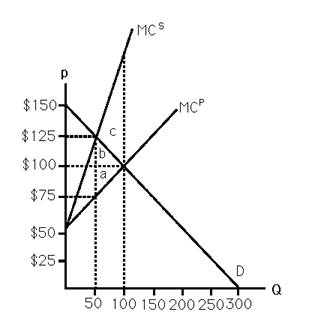

Figure 18.1

10) Figure 18.1 shows the market for steel ingots. If the market is competitive, then

A) the socially optimal quantity of steel is zero.

B) the socially optimal quantity of steel of 50 units is produced.

C) the socially optimal quantity of steel of 100 units is produced.

D) more than the socially optimal quantity of 50 units of steel is produced.

Answer: D

Diff: 1

Topic: The Inefficiency of Competition with Externalities

11) Figure 18.1 shows the market for steel ingots. An externality can be seen because

A) the social marginal cost exceeds the private marginal cost.

B) the private marginal cost exceeds the social marginal cost.

C) the optimal quantity of steel is zero.

D) not enough steel gets produced by the competitive market.

Answer: A

Diff: 1

Topic: The Inefficiency of Competition with Externalities

12) Figure 18.1 shows the market for steel ingots. If the market is competitive, then the deadweight loss to society is

A) a.

B) b.

C) c.

D) zero.

Answer: C

Diff: 1

Topic: The Inefficiency of Competition with Externalities

13) Figure 18.1 shows the market for steel ingots. If the market is competitive, then to achieve the socially optimal level of pollution, the government can

A) outlaw the production of steel.

B) institute a specific tax of $25.

C) institute a specific tax of $50.

D) institute a specific tax equal to area b.

Answer: C

Diff: 1

Topic: The Inefficiency of Competition with Externalities

14) Figure 18.1 shows the market for steel ingots. If the market is competitive, and the government institutes a $100 specific tax on steel, then

A) less than the socially optimal quantity of steel is produced.

B) the socially optimal quantity of steel of 50 units is produced.

C) the socially optimal quantity of steel of 100 units is produced.

D) more than the socially optimal quantity of steel is produced.

Answer: A

Diff: 1

Topic: The Inefficiency of Competition with Externalities

15) Figure 18.1 shows the market for steel ingots. The socially optimal quantity of steel is

A) 0 units.

B) 50 units.

C) 100 units.

D) produced if the market were competitive.

Answer: B

Diff: 1

Topic: The Inefficiency of Competition with Externalities

16) Figure 18.1 shows the market for steel ingots. The optimal quantity of pollution

Answer: D

Diff: 1

Topic: The Inefficiency of Competition with Externalities

17) In the presence of a negative externality in production, a monopoly will produce

A) more than the social optimum.

B) less than the social optimum.

C) the social optimum.

D) All of the above are possible.

Answer: D

Diff: 1

Topic: Market Structure and Externalities

18) Because a monopoly ignores external costs, it is possible that it will

A) produce the socially optimal quantity of a good.

B) produce more than the socially optimal quantity of a good.

C) produce less than the socially optimal quantity of a good.

D) produce zero pollution.

Answer: B

Diff: 1

Topic: Market Structure and Externalities

19) A monopoly might produce less than the socially optimal amount of pollution because

A) it likes to be a good citizen.

B) it sets price above marginal cost.

C) it earns economic profit.

D) it internalizes the external costs.

Answer: B

Diff: 1

Topic: Market Structure and Externalities

20) If the social marginal cost of a good is very high relative to the private marginal cost, then a monopoly will most likely

A) produce more than the social optimum.

B) produce less than the social optimum.

C) produce the social optimum.

D) produce zero pollution.

Answer: A

Diff: 1

Topic: Market Structure and Externalities

21) If both a monopoly and a competitive market with the same marginal would produce a quantity that is greater than the social optimum in a market because of externalities, then

A) welfare is greater under monopoly.

B) welfare is greater under competition.

C) welfare is the same for both market structures.

D) the social optimum must be zero.

Answer: A

Diff: 1

Topic: Market Structure and Externalities

22) A specific tax in a monopoly market equal to the marginal harm of pollution

Answer: D

Diff: 1

Topic: Market Structure and Externalities

23) The existence of externalities is due mainly to the fact that

A) monopolies tend to produce too little of a good anyway.

B) the optimal level of pollution is zero.

C) pollution is not a serious problem.

D) property rights are poorly defined.

Answer: D

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

24) Suppose two neighbors share a park. One neighbor, Al, leaves trash in the park. This bothers the other neighbor, Bert. According to Coase's theorem, the optimal level of trash in the park can be achieved if

A) Al is fined by the government.

B) Al has the right to leave trash and Bert cannot do anything about it.

C) Al has the right to leave trash and Bert can pay him to limit his dumping.

D) Bert moves.

Answer: C

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

25) Suppose two neighbors share a park. One neighbor, Al, leaves trash in the park. This bothers the other neighbor, Bert. According to Coase's theorem, one necessary condition to alleviate the externality is that

A) Al is fined by the government.

B) Al has the right to leave trash and Bert cannot do anything about it.

C) Bert has the right to a clean park and Al cannot leave trash.

D) Either Al or Bert owns the park.

Answer: D

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

26) Suppose two neighbors share a park. One neighbor, Al, leaves trash in the park. This bothers the other neighbor, Bert. According to Coase's theorem, the optimal level of trash in the park can be achieved if

A) someone is assigned property rights to the park.

B) government limits the use of the park.

C) nobody catches Al leaving the trash.

D) Bert moves.

Answer: A

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

27) Suppose twenty neighbors share a park. One of the neighbors, Al, leaves trash in the park. This bothers the other neighbors. According to Coase's theorem, assigning the property rights to the park to Al

A) will achieve the socially optimal quantity of trash.

B) will result in zero trash being dumped in the park.

C) might still not achieve the social optimum since coordinating the other nineteen neighbors can be costly.

D) is unfair.

Answer: C

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

Figure 18.2

28) Figure 18.2 shows the marginal benefit to a firm of polluting in the local river while producing its output, and the marginal cost to the surrounding neighbors. The marginal cost of production is zero for the firm. If property rights are not defined, how much pollution will occur?

A) 0 units

B) 500 units

C) 1000 units

D) more than 1000 units

Answer: C

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

29) Figure 18.2 shows the marginal benefit to a firm of polluting in the local river while producing its output, and the marginal cost to the surrounding neighbors. The marginal cost of production is zero for the firm. If the firm owns the river and there are thousands of surrounding neighbors, how much pollution is likely to occur?

A) 0 units

B) 500 units

C) 1000 units

D) more than 1000 units

Answer: C

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

30) Figure 18.2 shows the marginal benefit to a firm of polluting in the local river while producing its output, and the marginal cost to the firm's neighbor. The marginal cost of production is zero for the firm. If there is just one neighbor who owns the river, how much pollution is likely to occur?

A) 0 units

B) 500 units

C) 1000 units

D) more than 1000 units.

Answer: B

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

31) Figure 18.2 shows the marginal benefit to a firm of polluting in the local river while producing its output, and the marginal cost to the surrounding neighbors. The marginal cost of production is zero for the firm. If the firm owns the river and there is just one neighbor affected by the pollution, how much pollution is likely to occur?

A) 0 units

B) 500 units

C) 1000 units

D) more than 1000 units

Answer: B

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

32) Figure 18.2 shows the marginal benefit to a firm of polluting in the local river while producing its output, and the marginal cost to the surrounding neighbors. The marginal cost of production is zero for the firm. According to Coase's Theorem, which of the following scenarios is most likely to lead to the socially optimal level of pollution?

A) The firm owns the river and there are a thousand surrounding neighbors.

B) The firm owns the river and there is just one nearby neighbor.

C) The river is jointly owned by one thousand surrounding neighbors.

D) The firm owns the river, and therefore produces the social optimum no matter what.

Answer: B

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

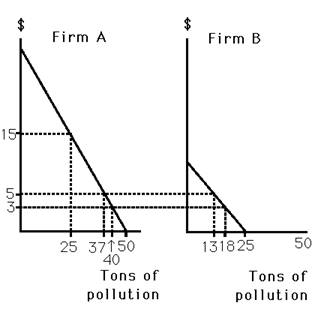

Figure 18.3

33) Figure 18.3 shows the marginal benefit from pollution for two firms. If each firm receives a marketable permit to pollute 25 units of pollution, which one of the following is most likely to happen?

A) Firm B will sell some pollution rights to firm A.

B) Firm A will sell some pollution rights to firm B.

C) Firm A will produce all 50 units of pollution.

D) Both firms will produce 25 units of pollution.

Answer: A

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

Figure 18.4

34) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. If nobody owns the lake, then

A) the beach shuts down and the chemical firm produces 1 ton of pollution.

B) the beach shuts down and the chemical firm produces 2 tons of pollution.

C) the beach operates and the chemical firm produces 1 ton of pollution.

D) the beach operates and the chemical firm produces 2 tons of pollution.

Answer: D

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

35) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. If the beach owner also owns the lake, and the chemical firm must pay $10 per ton to pollute, then

A) the beach shuts down and the chemical firm produces 1 ton of pollution.

B) the beach shuts down and the chemical firm produces 2 tons of pollution.

C) the beach operates and the chemical firm produces 1 ton of pollution.

D) the beach operates and the chemical firm produces 2 tons of pollution.

Answer: C

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

36) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. If the chemical firm owns the lake, and the beach owner must pay $10 to keep the chemical firm at just one ton of pollution, then

A) the beach shuts down and the chemical firm produces 1 ton of pollution.

B) the beach shuts down and the chemical firm produces 2 tons of pollution.

C) the beach operates and the chemical firm produces 1 ton of pollution.

D) the beach operates and the chemical firm produces 2 tons of pollution.

Answer: C

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

37) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. As long as someone owns the lake and the two parties can negotiate, then

A) the beach shuts down and the chemical firm produces 1 ton of pollution.

B) the beach shuts down and the chemical firm produces 2 tons of pollution.

C) the beach operates and the chemical firm produces 1 ton of pollution.

D) the beach operates and the chemical firm produces 2 tons of pollution.

Answer: C

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

38) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. Joint profits are maximized when

A) the beach shuts down and the chemical firm produces 1 ton of pollution.

B) the beach shuts down and the chemical firm produces 2 tons of pollution.

C) the beach operates and the chemical firm produces 1 ton of pollution.

D) the beach operates and the chemical firm produces 2 tons of pollution.

Answer: C

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

39) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. If nobody owns the lake, then

A) joint profits are zero.

B) joint profits are maximized.

C) joint profits are not maximized.

D) the beach will not operate because of too much pollution.

Answer: C

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

40) A common resource is best described as a resource where

A) there is a positive externality in consumption.

B) there is a negative externality in consumption.

C) there is a positive externality in production.

D) there is a negative externality in production.

Answer: B

Diff: 2

Topic: Common Property

41) To alleviate the commons problem, the government can

Answer: D

Diff: 0

Topic: Common Property

42) In the case of a good that has no exclusion and no rivalry, private markets fail because

A) of free ridership.

B) this is a natural monopoly.

C) profit is driven down to zero.

D) the quantity produced will exceed the social optimum.

Answer: A

Diff: 0

Topic: Public Goods

43) A public good in which exclusion is possible is called

A) an exclusive good.

B) a common good.

C) an impure good.

D) a club good.

Answer: D

Diff: 0

Topic: Public Goods

44) Markets tend to produce too little of an excludable public good because

Answer: B

Diff: 1

Topic: Public Goods

45) The total demand for a public good is found by

A) horizontally summing all individual demands.

B) vertically summing all individual demands.

C) finding the demand from the median voter.

D) dividing the marginal cost of the good by the number of voters.

Answer: B

Diff: 1

Topic: Public Goods

46) The efficient quantity of a pure public good occurs when the marginal cost of producing that good equals the

A) marginal benefit to the median voter.

B) marginal benefit to each individual.

C) sum of all individual marginal benefits.

D) sum of all individual marginal benefits divided by the number of voters.

Answer: C

Diff: 1

Topic: Public Goods

47) When majority rule voting is used to determine whether to purchase a public good,

A) the efficient outcome is not assured.

B) the median voter gets her way.

C) the sum of the marginal benefits is ignored.

D) All of the above.

Answer: D

Diff: 2

Topic: Public Goods

48) When majority rule voting is used to determine whether to purchase a public good,

A) the efficient outcome is assured.

B) the median voter gets her way.

C) the sum of the marginal benefits must equal marginal cost.

D) the marginal benefit of the good to the median voter equals the good's marginal cost.

Answer: B

Diff: 2

Topic: Public Goods

TRUE/FALSE/EXPLAIN

1) In the presence of a negative externality generated by producing a good, a competitive market will produce more of that good than is socially optimal.

Answer: True. Firms in that market only consider their private costs and produce a quantity that equates price with the private marginal cost. Producers ignore the external costs to others. As a result, p = M Cp instead of p = M Cs.

Diff: 0

Topic: The Inefficiency of Competition with Externalities

2) To maximize welfare in a competitive market that has a negative externality in production, government should tax a pollution-generating good at a specific tax equal to the marginal cost of producing the good.

Answer: False. The tax should equal the marginal harm of the pollution at the socially optimal quantity of the good.

Diff: 1

Topic: The Inefficiency of Competition with Externalities

3) Because a monopoly will produce less of a good than a competitive market will, welfare is always greater under monopoly than under competition in the presence of a negative externality.

Answer: False. If monopoly produces more than the social optimum, then it does generate greater welfare than competition. If monopoly produces less than the social optimum, then it may or may not generate greater welfare.

Diff: 2

Topic: Market Structure and Externalities

4) Firms that are most likely to buy marketable pollution rights are those that produce the most pollution per unit of output produced.

Answer: False. Firms that will buy pollution rights are those whose products are worth a lot relative to the harm from pollution they create.

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

5) The efficient quantity of a public good occurs when the marginal cost of providing that good equals the sum of the marginal benefits to all individuals.

Answer: True. The demand for the public good is found by vertically summing so that we have the sum of the marginal benefits at each quantity.

Diff: 2

Topic: Public Goods

PROBLEMS

1) Suppose that in the market for paper, demand is p = 100 - Q. The private marginal cost is MCp = 10 + Q. Pollution generated during the production process creates external marginal harm equal to MCe = Q. What specific tax would result in a competitive market producing the socially optimal quantity of paper?

Answer: The socially optimal quantity of paper is found by setting MCp+ MCe = p or 10 + Q + Q = 100 - Q. Rearranging yields Q = 30. At this level of output society incurs an external cost of 30. This is the specific tax that would yield the socially optimal quantity. To check set MCp + tax = 100 - Q. This yields Q = 30.

Diff: 1

Topic: The Inefficiency of Competition with Externalities

2) Suppose that in the market for paper, demand is p = 100 - Q. The private marginal cost is MCp = 10 + Q. Pollution generated during the production process creates external marginal harm equal to MCe = Q. Is social welfare greater under monopoly or under competition?

Answer: First, the socially optimal quantity of paper is found by setting MCp + MCe = p or 10 + Q + Q = 100 - Q. Rearranging yields Q = 30. The competitive equilibrium is found by setting MCp = p or 10 + Q = 100 - Q. Rearranging yields Q = 45. The deadweight loss of those additional units equals (45 - 30) * 45/2 = 337.50. Under monopoly, the firm sets MCp = 100 - 2Q or Q = 30. The monopoly produces the socially optimal quantity, and therefore has no deadweight loss. Social welfare is greater under monopoly.

Diff: 1

Topic: The Inefficiency of Competition with Externalities

Figure 18.1

3) Suppose that the market for steel is shown in Figure 18.1. What specific tax would result in a competitive market producing the socially optimal quantity of steel?

Answer: The social optimum occurs when 50 ingots are produced. At this level, the marginal external cost is $50. Thus, a specific tax of $50 will yield the socially optimal quantity.

Diff: 1

Topic: The Inefficiency of Competition with Externalities

4) In terms of cost-benefit analysis, explain why a competitive market produces too

much pollution.

Answer: At the socially optimal level of production, welfare is maximized and the marginal benefit from less pollution equals the marginal cost of less output. However, a competitive market produces more pollution than is socially optimal, and the marginal cost of less output is greater than the marginal benefit from less pollution.

Diff: 1

Topic: The Inefficiency of Competition with Externalities

5) Suppose that the market for steel is shown in Figure 18.1. Is social welfare greater under monopoly or under competition?

Answer: Under competition, the deadweight loss equals area C. To find the monopoly outcome, draw the MR curve for the monopoly that has the same vertical intercept as the demand curve but is twice as steep. Where MR = M Cp determines the level of output the monopoly produces. This output is greater than 50 but less than 100. Social welfare is therefore greater under monopoly, since the monopoly quantity is closer to the socially optimal quantity than the competitive quantity.

Diff: 2

Topic: Market Structures and Externalities

6) Explain how a specific tax equal to the marginal harm of pollution can increase or

decrease total welfare in a monopoly market.

Answer: If the monopoly is producing more output and pollution than the social optimum, then a specific tax equal to the marginal harm of pollution will increase total welfare. However, a monopoly may produce less output and thus pollution than is socially optimal. If this is the case, then a tax will decrease output more and lower welfare.

Diff: 1

Topic: Market Structures and Externalities

7) A firm operates and produces pollution that only harms an individual, Bob. The

firm and Bob both know the costs and benefits of reducing pollution. Neither the firm nor Bob acts strategically while bargaining, and there are no transaction costs associated with bargaining. Explain how the efficient level of pollution occurs no matter whether the firm or Bob owns the property right to pollution.

Answer: If the firm has the right to pollute, then Bob can bargain with the firm. Bob will pay the firm up to the point where his per unit payment to reduce the pollution equals the marginal benefit he receives from pollution. This will be the efficient level of pollution. If Bob has the right to have no pollution, then the firm will pay to pollute until this cost equals the marginal benefit of a unit of production. This will result in the efficient level of pollution. Thus, no matter which party owns the property right, the efficient level of pollution will result.

Diff: 1

Topic: Allocating Property Rights to Reduce Externalities

Figure 18.3

8) Figure 18.3 shows the marginal benefit from pollution for two firms. If both firms receive a marketable permit to pollute 25 units of pollution each, how much will each firm pollute and how much will a permit for one unit of pollution be worth?

Answer: Firm B will sell permits to firm A until the marginal benefits are the same for both firms. Firm A will generate 37 tons of pollution and firm B will generate 13 tons of pollution. The market value of a permit will be $5.

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

Figure 18.4

9) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. Determine the Nash equilibrium without property rights.

Answer: Without property rights, operating is a dominant strategy for the beach owner and 2 tons of pollution is a dominant strategy for the chemical firm.

Diff: 0

Topic: Allocating Property Rights to Reduce Externalities

10) Figure 18.4 shows the payoff matrix for two firms. A chemical firm must choose between a low level of production which yields one ton of pollution into a nearby lake and a high level of production which yields two tons of pollution into the nearby lake. A private beach on the lake must decide whether to operate or not. Increased pollution reduces the number of people who wish to visit the beach. If the chemical firm owns the lake and the beach owner must pay the chemical firm $10 to produce only one ton of pollution, what is the outcome? If the beach owner owns the lake and the chemical firm must pay $10 per ton of pollution, what is the outcome? Compare this result to the case where nobody owns the lake.

Answer: If the chemical firm owns the lake, the bottom two cells do not change, the top cells change from (15, 0) and (15, 25) to (25, -10) and (25, 15). Producing just 1 ton of pollution is the firm's dominant strategy. The beach will operate, and both enjoy joint profits of 40. If the beach owner owns the lake, the top cells become (5, 10) and (5, 35). The bottom cells become (0, 0) and (0, 10). Producing 1 ton of pollution is a dominant strategy for the firm. The beach operates and they enjoy joint profits of 40. Without property rights, the dominant strategy for the chemical firm is to produce 2 tons of pollution.

Diff: 2

Topic: Allocating Property Rights to Reduce Externalities

11) Explain the externality generated when a shepherd grazes sheep in a field which is

common property that several other shepherds use.

Answer: The shepherd allows his sheep to graze in the field until the marginal benefit of grazing there equals the marginal cost to the shepherd. However, by grazing his sheep in the field, the shepherd increases the cost of grazing to all the other shepherds. This occurs because less grass is available for all other sheep. Each shepherd's grazing decision affects the costs to all the others, but the shepherds do not consider the effects on others when making their own decisions.

Diff: 1

Topic: Common Property

12) Explain why the social demand curve for a public good is the vertical sum of the

demand curves of each individual.

Answer: A public good lacks rivalry, so many people can get pleasure from the same unit of output. Thus, for each unit of public good, the total willingness to pay is the sum of everyone's willingness to pay because everyone can consume the good.

Diff: 1

Topic: Public Goods.

13) Suppose three neighbors must vote on the installation of a traffic light that costs $210. The cost of the light will shared by all three. Voter A values the light at $50; voter B values the light at $50; and voter C (who drives the most) values the light at $200. If the voting rule is that the majority wins, does the light get purchased? Is it efficient to purchase the light?

Answer: The cost of the light to each voter is $70. Since MC > MB for two of them, the light does not get purchased. It is efficient to purchase the light since SMB = 300 which exceeds the MC of 210.

Diff: 1

Topic: Public Goods

14) Suppose 100 citizens each derive marginal benefit from submarines according to the function MB = 10 - Q. If subs cost $100 each to produce, what is the efficient quantity of submarines?

Answer: The market demand is SMB = 1000 - 100Q. Setting this equal to the MC of 100 yields a quantity of 9. If the cost is shared equally, each citizen pays $1 for the ninth submarine, which they each value at $1.

Diff: 1

Topic: Public Goods

Figure 18.5

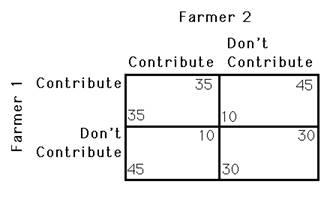

15) Two neighboring farmers must each decide whether to contribute to a fence that separates their properties. The fence costs a total of $20. Both farmers currently have a profit of $30 each. With a fence to keep each farmer's animals from wandering onto the other's property, both farmers would experience a $15 rise in profits. Draw the payoff matrix and discuss the possible outcomes.

Answer: See Figure 18.5. This is a prisoners' dilemma. The dominant strategy for each is to not contribute—to be a free rider. Yet, both farmers are better off contributing. The dilemma can resolved through compulsion—for example a tax—or, since there are only two of them, social agreement. Cooperation and trust are required to get the fence built. Good fences make good neighbors, and good neighbors make good fences.

Diff: 2

Topic: Public Goods

Source: http://static.gest.unipd.it/~birolo/didattica08/materiale07/materiale_Perloff/testbank-1/tbch18.doc

Web site to visit: http://static.gest.unipd.it/

Author of the text: not indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The following texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

www.riassuntini.com